- 06/04/2022

Payment Processing

How merchant processors work

- By Gallant Dill

A brief description of how online payment processing software works

Businesses in modern society cannot think of surviving without innovative software incorporated into their day-to-day processes. A platform like a website can even take something as small as a local flower shop to a national level. An internet processing software can make operations such as delivery and bill quicker and easier.

You might think it’s easy but accepting payments is a significant challenge faced by most merchants nowadays. It requires a solid Fintech infrastructure solution combining multiple routes into a single payment portal.

You need to understand the payment processing industry to truly know what requirements you must fulfill to take your business to the next level. Luckily, we know the main components of payment processing, its functions, and the requirements you will need for this kind of FinTech infrastructure.

Payment Processing as a modern necessity

People have always wanted convenience and digital payments do just that. Paying through your phone has to be one of the easiest things ever for a shopper. From business communications to online shopping, you can do anything you want with a tap.

It does not matter if you have a souvenir shop or have an online website. Having a contactless payment processing method or software that helps your customers pay online is necessary if you care about your business. According to a survey conducted by American Express, customers spend up to 18% more time using their credit cards than cash, which is why 71% of merchants have given the nod to online digital payments.

How does it work?

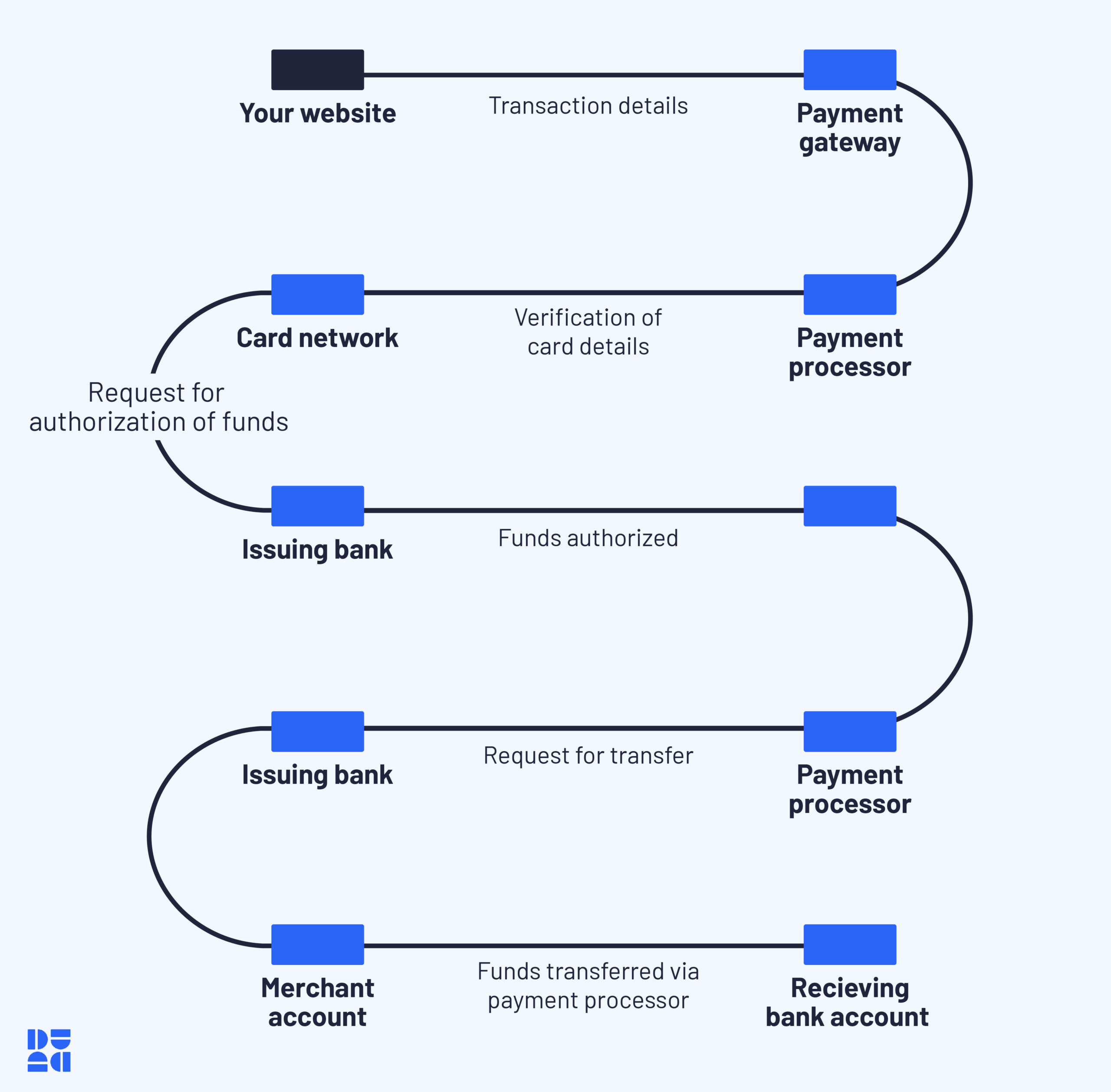

Payment processing can be categorized into three components. Let’s get right into details:

Merchant Account

The place where all money ends up. Once you get your payment, it gets credited into this account. A merchant account allows your business to process online payments. You can activate it through a payment processing company, a contractor, or a bank.

Payment Processor

A payment processing company is responsible for transactions between your bank and your customers’ bank. Your payment processor is your go-to when you have any questions regarding payment. Guarding your money is also their number one priority. They ensure secure transactions by validating credit card information and protecting you from frauds and scams.

Payment Gateway

This is your digital cashier. The payment gateway mediates all transactions between your website and payment processor. For security purposes, your payment gateway connects your merchant account with card issuers such as American Express, Visa, or MasterCard.

Internet Payment processing works with the following steps

Step 1

Your customer selects their item of choice and adds it to the cart.

Step 2

Transaction is processed by the merchant.

Step 3

The transaction is securely sent through the payment gateway to the processor.

Step 4

The processor checks all details and approves the transaction.

Step 5

The customer’s bank begins the transaction process through the processor.

Step 6

The processor credits money into the merchant’s bank .

Step 7

The processor sends the stats of the transaction to the gateway.

Step 8

The merchant receives an alert on their smartphone or notification after the payment regarding the successful transaction.

Step 9

The merchant receives the money for the item sold.

All of this happens within seconds and in the background. Now that you know how the process works kick back, relax and leave sending proposals and collecting payments to us. We take pride in being your all-in-one payment gateway and invoicing platform.

We love those who are good at doing business. We allow you to focus entirely on that and leave the back-end work to us. Our services will enable you to keep the costs for your customer as low as possible. You get every feature for free, and this will be your easiest business decision yet. There’s no catch! We just take 2.9% of your transaction, which is way lower than other payment gateways in the market.

Get started with BusinessToolKit for free! Visit our website to learn more.